Investigation of Bank Failures

Data provided from Kaggle: https://www.kaggle.com/fdic/bank-failures

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

df = pd.read_csv("bank-failures/banks.csv")

df.head()

df.count()

Financial Institution Number 2883

Institution Name 3484

Institution Type 3484

Charter Type 3484

Headquarters 3484

Failure Date 3484

Insurance Fund 3484

Certificate Number 2999

Transaction Type 3484

Total Deposits 3484

Total Assets 3333

Estimated Loss (2015) 2509

dtype: int64

Data Cleaning

df = df.join( df["Headquarters"].str.split(",", expand = True))

df["D/A"] = df["Total Deposits"]/df["Total Assets"]

df["Failure Date"] = pd.to_datetime(df["Failure Date"])

df = df.rename(columns = {0:"City", 1:"State", 2:"Del"})

df = df.drop("Del", 1)

df.count()

Financial Institution Number 2883

Institution Name 3484

Institution Type 3484

Charter Type 3484

Headquarters 3484

Failure Date 3484

Insurance Fund 3484

Certificate Number 2999

Transaction Type 3484

Total Deposits 3484

Total Assets 3333

Estimated Loss (2015) 2509

City 3484

State 3484

D/A 3333

dtype: int64

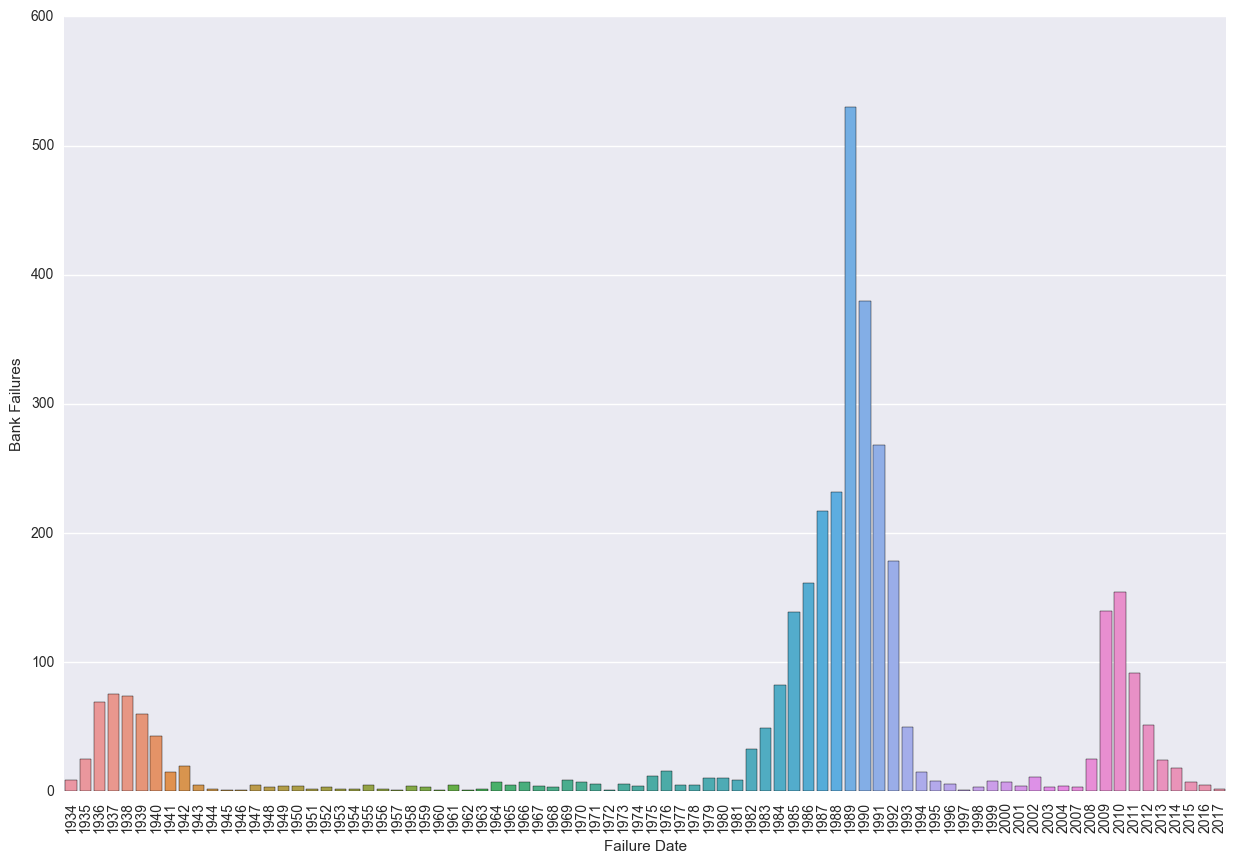

Time Plots

Not unexpectedly, we see the largest peaks in the lates 80’s and early 90’s corresponding to the Savings and Loan crisis, 2009/2010 corresponding to the GFC and the late 30’s with The Great Depression. What would be more interesting would be to look at the percentage failures of banks (to do.)

fails_by_year = df['Failure Date'].groupby([df["Failure Date"].dt.year]).agg('count')

plt.figure(figsize=(15,10))

sns.barplot(fails_by_year.index, fails_by_year)

plt.xticks(rotation="vertical")

plt.ylabel("Bank Failures")

plt.show()

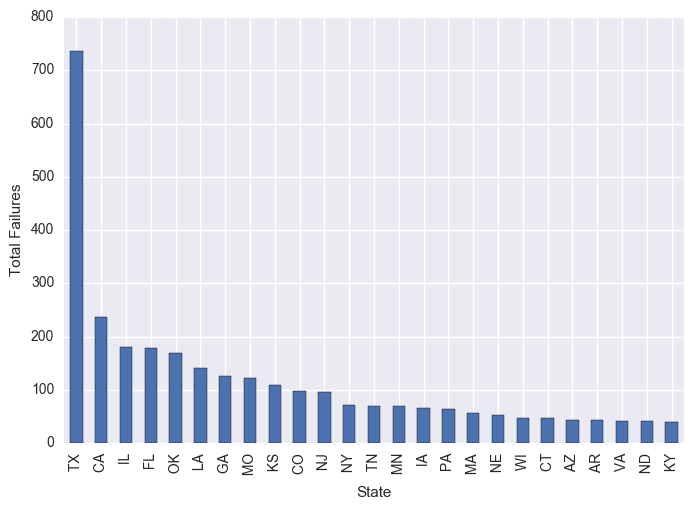

Geographical Plots

df.groupby("State").count()["Failure Date"].sort_values(ascending=False)[0:25].plot(kind="bar")

plt.ylabel("Total Failures")

plt.show()

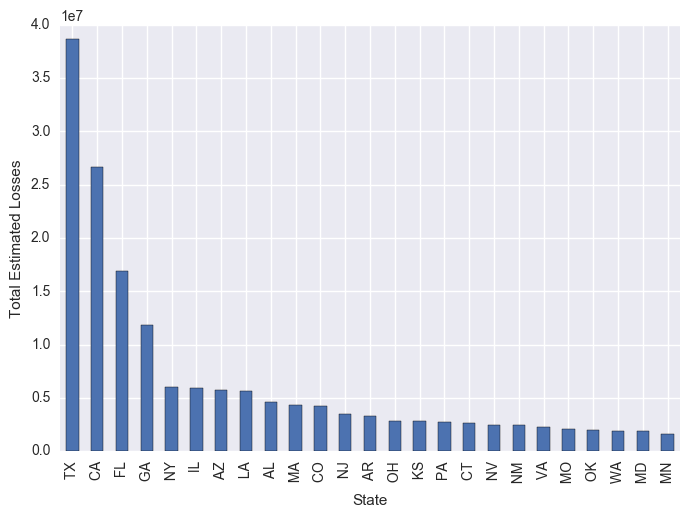

We see that TX has both the largest number of failures and the largest total estimated losses. Let’s see whose contributing to this.

df.groupby("State").sum()["Estimated Loss (2015)"].sort_values(ascending=False)[0:25].plot(kind="bar")

plt.ylabel("Total Estimated Losses")

plt.show()

df[df["State"] == " TX"].sort_values(by = "Estimated Loss (2015)", ascending = False)[0:10]

| Financial Institution Number | Institution Name | Institution Type | Charter Type | Headquarters | Failure Date | Insurance Fund | Certificate Number | Transaction Type | Total Deposits | Total Assets | Estimated Loss (2015) | City | State | D/A | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1520 | 6938.0 | UNIVERSITY FEDERAL SAVINGS | SAVINGS ASSOCIATION | FEDERAL/STATE | HOUSTON, TX | 1989-02-14 | RTC | 30685.0 | ACQUISITION | 3776427 | 4480389.0 | 2177985.0 | HOUSTON | TX | 0.842879 |

| 1377 | 2846.0 | FIRST REPUBLICBANK-DALLAS, N.A. | COMMERCIAL BANK | FEDERAL | DALLAS, TX | 1988-07-29 | FDIC | 3165.0 | ACQUISITION | 7680063 | 17085655.0 | 2017459.0 | DALLAS | TX | 0.449504 |

| 2363 | 2124.0 | SAN JACINTO SAVINGS | SAVINGS ASSOCIATION | FEDERAL/STATE | HOUSTON, TX | 1990-11-30 | RTC | 31058.0 | ACQUISITION | 2894745 | 2869629.0 | 1700654.0 | HOUSTON | TX | 1.008752 |

| 1506 | 7070.0 | GILL SA | SAVINGS ASSOCIATION | FEDERAL/STATE | SAN ANTONIO, TX | 1989-02-07 | RTC | 31503.0 | ACQUISITION | 1448432 | 1207294.0 | 1659803.0 | SAN ANTONIO | TX | 1.199734 |

| 1618 | 7335.0 | COMMONWEALTH SAVINGS ASSOC. | SAVINGS ASSOCIATION | FEDERAL/STATE | HOUSTON, TX | 1989-03-09 | RTC | 31896.0 | TRANSFER | 1608452 | 1647893.0 | 1613353.0 | HOUSTON | TX | 0.976066 |

| 1714 | 2985.0 | MBANK DALLAS, NATIONAL ASSOCIATION | COMMERCIAL BANK | FEDERAL | DALLAS, TX | 1989-03-28 | FDIC | 3163.0 | ACQUISITION | 4033803 | 6556056.0 | 1610809.0 | DALLAS | TX | 0.615279 |

| 1517 | 6952.0 | BRIGHT BANC | SAVINGS ASSOCIATION | FEDERAL/STATE | DALLAS, TX | 1989-02-10 | RTC | 31095.0 | ACQUISITION | 3004443 | 4388466.0 | 1307798.0 | DALLAS | TX | 0.684623 |

| 1823 | 2100.0 | VICTORIA SA | SAVINGS ASSOCIATION | FEDERAL/STATE | SAN ANTONIO, TX | 1989-06-29 | RTC | 29378.0 | PAYOUT | 855717 | 882849.0 | 968972.0 | SAN ANTONIO | TX | 0.969268 |

| 1627 | 2104.0 | BANCPLUS SAVINGS ASSOCIATION | SAVINGS ASSOCIATION | FEDERAL/STATE | PASADENA, TX | 1989-03-09 | RTC | 31128.0 | ACQUISITION | 923026 | 751461.0 | 964160.0 | PASADENA | TX | 1.228309 |

| 1619 | 7429.0 | BENJAMIN FRANKLIN SA | SAVINGS ASSOCIATION | FEDERAL/STATE | HOUSTON, TX | 1989-03-09 | RTC | 30761.0 | ACQUISITION | 2004722 | 2641392.0 | 882240.0 | HOUSTON | TX | 0.758964 |

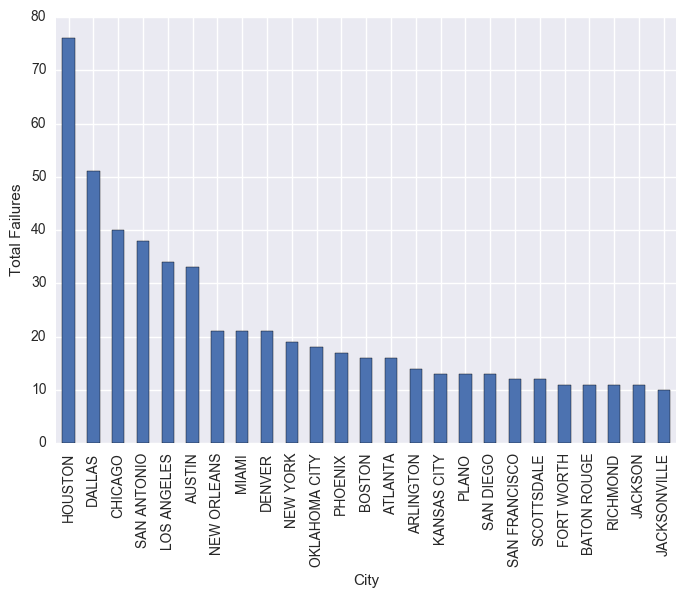

df.groupby("City").count()["Failure Date"].sort_values(ascending=False)[0:25].plot(kind="bar")

plt.ylabel("Total Failures")

plt.show()

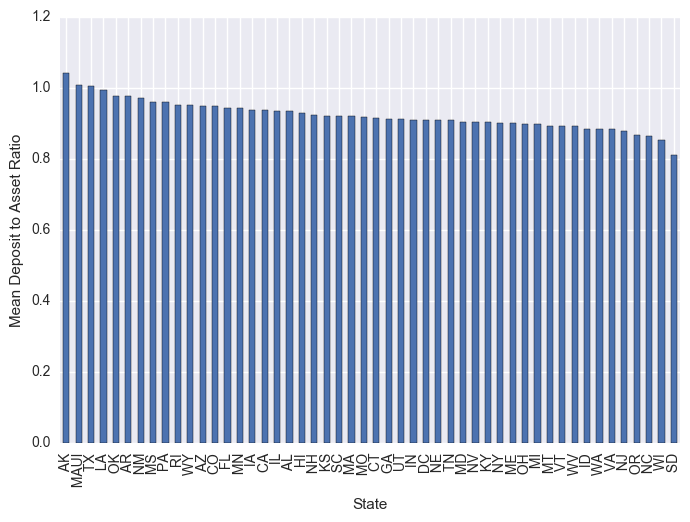

df.groupby("State").mean()["D/A"].sort_values(ascending=False)[0:50].plot(kind="bar")

plt.ylabel("Mean Deposit to Asset Ratio")

plt.show()

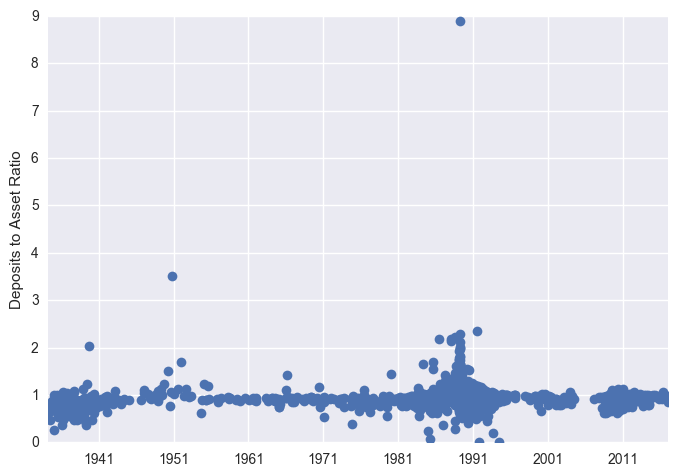

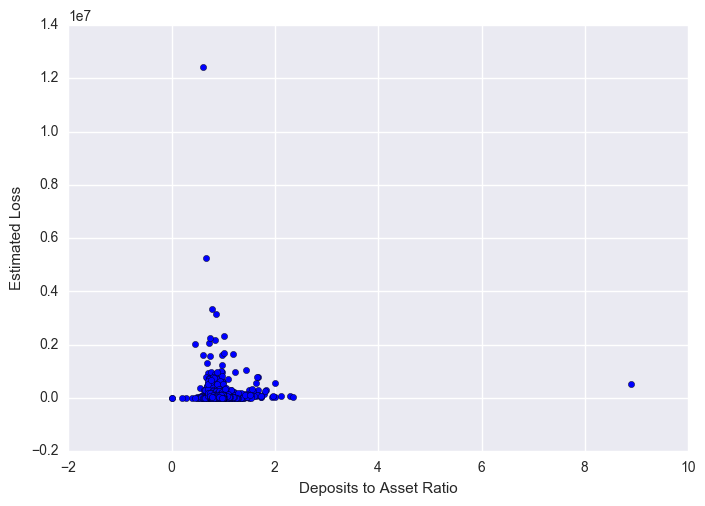

Deposit to Assets

Ignoring the possibility that this is not real and hence not inflation adjusted. Interesting to see whether there is any relationship between D/A and the losses suffered. It looks like there is no strong correlation at all, which would indicate that it’s not necessarily a mismanagement of deposits/assets which have driven bank failures, but other factors. Typically it’s liquidity which brings the banks down, after sustaining a systemic asset shock (housing/mortgage exposures in the GFC).

plt.scatter(x = df["D/A"], y = df["Estimated Loss (2015)"])

plt.xlabel("Deposits to Asset Ratio")

plt.ylabel("Estimated Loss")

plt.show()

plt.plot_date(x = df["Failure Date"], y = df["D/A"])

plt.ylabel("Deposits to Asset Ratio")

plt.show()